Not to sound like a broken record, but here’s a great example of what I was talking about in my recent post entitled “5 benefits in thinking about revenue models right from the start“.

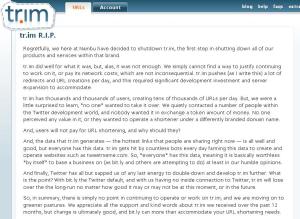

A couple of weeks ago, Nambu, the parent company of the URL shortening service tr.im, announced that they will be shutting the service down. You should read their entire post because it is very well written and makes some very good points that should serve as lessons to virtually any aspiring business out there.

I’ve also captured a jpeg image of the page in case they take down the original. Click the image on the right to read the entire text.

I’ve also captured a jpeg image of the page in case they take down the original. Click the image on the right to read the entire text.

Here’s a synopsis of that post.

- tr.im is being shut down.

- It is good at what it does and is a popular service, but that is not sufficient.

- tr.im’s costs are real, both in terms of development effort and operational costs.

- Those costs need to be recouped.

- But there is no way to monetize URL shortening and the quest to find an acquirer failed. [SK – probably because there is no way to monetize it].

- Users will not pay for URL shortening. [SK – URL shortening is a commodity; a cheap one at that.]

- The data that tr.im collects – what URLs people are shortening and clicking on – is of little value to outsiders because “everyone has that data” as it is harvested by bots. [SK – the collected data is also a commodity.]

- An 800lb gorilla named Twitter has anointed a tr.im competitor (bit.ly) as the URL shortener of choice. [SK – if your success is dependent on a single larger entity, be the clown fish to their anemone!]

- This effectively blocks growth prospects for tr.im (and by inference, other competitors to bit.ly)

I use tr.im. I like it. It’s simple to use and gives me some good analytic data about click-throughs on shortened URLs I post around the web.

But I always wondered how they made money. For as long as I’ve used the web, tinyurl.com was the only URL shortener that I knew. Then with Twitter, others jumped in, providing extra services, like accounts, click-through stats and simple analytics. Here’s a chart of monthly visitor statistics.

Clearly, it was a losing battle for tr.im in terms of traffic. Even the venerable tinyurl, long the king of URL shortening is falling in traffic, with bit.ly continuing to climb.

So the question is: how will bit.ly cover it’s costs? The server and operational costs must be significantly more than that of tr.im.

How is (or will) bit.ly generate revenue? Can they sell their data? If so, to whom?

Does anyone have any insight into how bit.ly does or will create a sustainable revenue stream? And what has Tinyurl been doing all these years to pay it’s bills? I’m genuinely curious.

Saeed