BY ALAN ARMSTRONG

If you want to improve your win rates in the market, it is important that you study wins, and not just losses.

Many well intentioned leaders hear “Win/Loss Analysis”, and think immediately of “Loss Analysis”, or studying reasons why we lose. While this is of course valuable, mere “Loss Analysis” will leave you with an incomplete picture and limit your success.

OK, fine, you say, but we have success stories, so we know why we win.

Sorry, I disagree. “Success stories” generated by marketing do not qualify as Win Analysis because they are written to persuade new prospects to buy, not to study the existing account objectively.

What problem are we solving?

Let’s take a step back. Below I have listed several of the symptoms that my clients report to me. Granted, when you call a research firm, you are calling the doctor with a problem. But I have worked long enough to know that these problems are fairly pervasive, so you may recognize at least one or two:

- Lost a few big deals: We have recently lost a few big deals that we thought we were going to win. We have no idea why. Can you find out?

- Increased price pressure: We used to lead the market, but a competitor is really starting to beat us up. We are still winning, but we are under huge pressure to discounts. Our average sale price (ASP) is declining.

- Decreased win rates: Never mind just the big deals! We are losing more deals, period. Our win rates have declined.

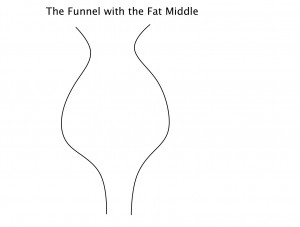

- The Funnel with the FAT middle: Need I say more about this? We have enough leads, but

they are coming in much faster than they close. Many deals seem like “non-decisions” rather than losses. I call these deals “stuck”. These deals collect like excess calories … in the middle. You call me because you want to know what’s going on. Close some, kill others, and move others back to marketing / lead nurturing.

they are coming in much faster than they close. Many deals seem like “non-decisions” rather than losses. I call these deals “stuck”. These deals collect like excess calories … in the middle. You call me because you want to know what’s going on. Close some, kill others, and move others back to marketing / lead nurturing.

Each of these situations is unique and calls for a different approach to diagnosis.

In the first situation, it’s fine to log a few interviews to find out what happened in the large deals that you lost. That work will certainly be valuable, you will learn a lot, and it may even be sufficient. But if you have one of symptoms 2 through 4 above, you need a different approach.

Define the “Deal Persona”

Before you start interviewing, I recommend you get clear on what kind of deal you are trying to understand. You can segment deals by size, by competitor, by geography, or by channel, to name just a few. Look at several representative deals, both winners and losers, and try to write a general description of the concerns and the questions you have. I call this the “Deal Persona”. Like buyer and user personas, this is an amalgam of deals of the sort that we are trying to understand.

For example, you may be concerned that you are underperforming in deals greater than $250k where competitor X shows up. That is a short but sufficient description. If you can flesh out some of the other aspects of deals like that (what symptoms is the field reporting back?), it will help your research.

Select the targets

Once you have the deal persona and a few representative examples, solicit the field for more deals that match the persona. You may be surprised in two ways: You may be overwhelmed with examples, or find a total scarcity. If you find a scarcity but you know that such deals exist, you may have hit on a cultural problem with the sales force; they may be afraid of sharing vulnerability, and this is another issue entirely.

Start with wins

Once you have selected the deals, I highly recommend you start by interviewing wins.

There are really two questions that you are trying to answer:

- why do we lose as much as we do?

- What can we do to win more?

Losses will tell you the answer to question #1, but your ultimate goal is to win more, and for that, you need to study wins also.

Wins will give you the recipe for a successful deal. For example:

- They will tell you things you may not know about which factors were most important to them. Was it service? Was it product capabilities? Be curious!

- They will tell you which competitive capabilities they liked, and how they decided to buy your product anyway.

- After the deal they may reveal aspects of their negotiation strategy. (Getting insight into this area is a fine, fine art because you can’t really ask the questions directly.)

I think it’s best to start by completely understanding the winning recipe. Your wins are not 100% sold on your product; they probably liked things about they others, but they still chose you. Find out why, and use those reasons to inform your loss analysis.

In the end, you want to know how you can improve your results. If you know the winning formula, you can figure out why it didn’t work in the lost accounts.

Would love to hear your feedback and further questions on this topic.

– Alan

PS: If you liked this article, please retweet to your followers! New post from @OnPM, “Win/Loss Analysis MUST include wins (success stories don’t count)” http://bit.ly/iIMGDB #prodmgmt #prodmktg #sales